Now that you have purchased that fancy new bike or a well maintained pre-owned (used) car with your hard-earned money, you are probably planning for that much needed road trip with your family. However, just before you head out, I want you to see if you got the best deal on your vehicle insurance, a small yet commonly missed element by many while not just buying a new vehicle but also renewing the policy. If in case you didn’t take insurance for your vehicle and the occupants, then I can only hope you don’t get to see the effects of that decision as we don’t control a lot of things in this world and accidents are one of those things.

So, if you have a copy of your policy by your side, just grab it and you’ll see some of the following elements in your policy. If not, that’s fine! I will go over all the key details…

Key ingredients of an insurance policy

There are two basic elements that make up the total premium you pay for an insurance policy.

- Own Damage (OD) Premium

- Third Party (TP) Premium

So, let’s say you are reversing your car from a parking lot and you are inspired, maybe a bit too much, by the latest James Bond movie and do it too fast. Before you realize that you are just super normal like all of us and not a super hero, you end up nicking the bumper of another car and to your shock the owner is in the car. Sorry to say this but there is no way out of this situation! Unless you have an insurance policy because no. (2), third party premium, will help you for damage caused to third party property (in simple words, damage to the other car or other properties) or third party bodily injury or death (in simple words, damage to the other car owner or occupants or public from the incident). Just imagine how much it would have costed in case you didn’t have insurance. Now you might say, I’m a very disciplined driver and I never had an accident before! Well! What if you are the innocent owner who got hit in this incident? As I said earlier, you can never control certain things in your life.

Now, let’s say you are the innocent owner of a car, which got hit by a careless super hero who was making a ‘blind’ U-turn but this one is driving a truck and not a car. But since you have been visiting that Balaji temple every Friday, god has been kind enough to brush you off with just cosmetic injuries. Although, your car is not that lucky and it sustained such heavy damages that it would cost more to get it repaired now than what you could have got if you had sold it last week as your wife suggested. The only saving grace here is if you had purchased an insurance policy and chose to pay no. (1), the ‘optional’ own damage (OD) premium. This would have covered damage to your car not just in case of an accident but from other incidents like fire, theft, riot and strike, earthquake, flood etc. I say optional because one can choose to buy just third party coverage and not own damage but I’d never recommend doing so because of the obvious risks involved. Are you really willing to cover for damage to others or others’ property and not yours?

Ok! So now that you have understood the two key elements of an insurance policy, let’s dig a little deeper because this is where most of the discounts and value lie.

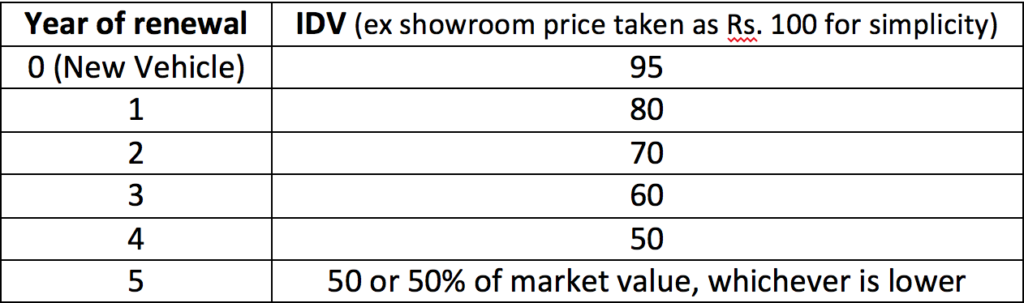

- Insured Declared Value (IDV): Sometimes IDV is even referred to as Sum Insured and this is what insurance companies use as reference to identify how much you would be paid in case of a claim say due to theft of your vehicle or total damage beyond repair after an accident (or total loss as they usually call in the insurance industry). The IDV for a new vehicle is calculated based on ex-showroom price of the vehicle and is depreciated as per the following schedule for every renewal, which happens annually. So next time, just make sure you get the maximum IDV possible and don’t take anything less or more (yes! Some even offer more than possible and this can delay your claim process further)

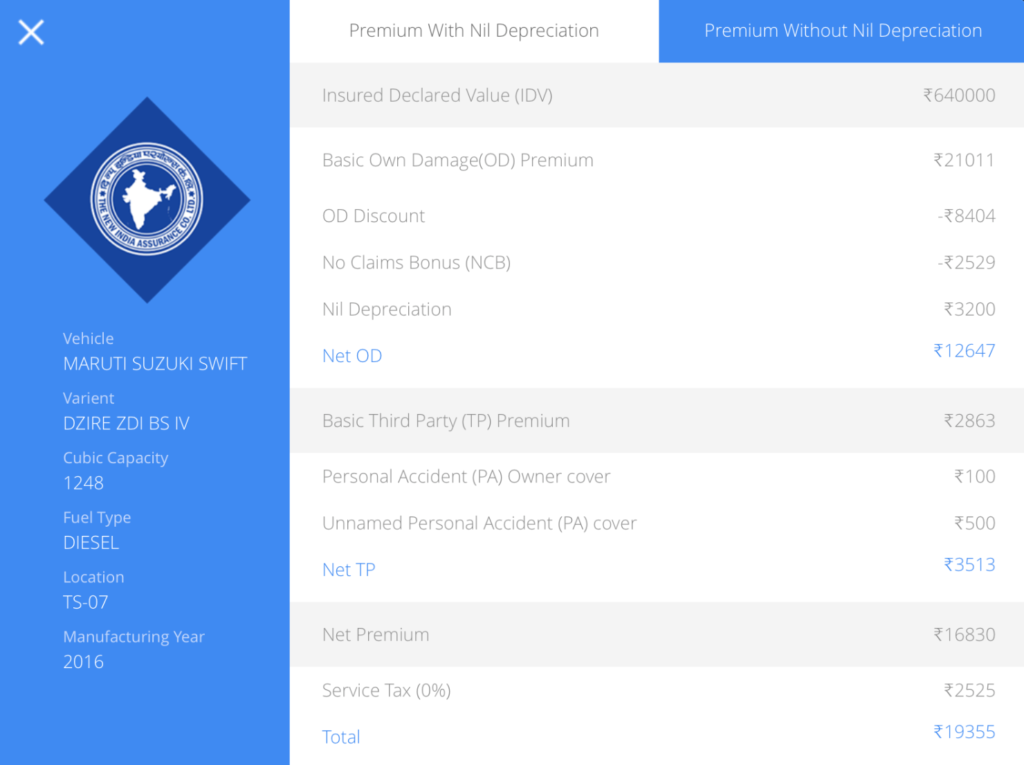

- Own Damage (OD) premium and discount: Your OD premium calculation depends on multiple factors such as IDV, your vehicle’s engine cubic capacity (cc), your location (geographical zone) and type of vehicle. Sounds complicated right! Yes but don’t worry that’s why we are here to help you and our motto is to make insurance simple. Most of the discounts are offered on OD part of the premium and this is where you need to keep an eye on if you want the best bargain. The OD discount is what the insurance company (not a manufacturer or a dealer or a broker or a website) offers to a consumer and only the insurance company is entitled to provide the discount as per the regulations. That being said, intermediaries like us, the legal ones to sell insurance in India and not any manufacturer or dealer, have flexibility to offer a discount within a certain limit set by the insurance company. This can vary based on the channel we sell, the customer, the vehicle etc. Sometimes these discounts can go as high as 70-80% (very rarely and very unhealthy for the market) but 50% is the usual norm. So, next time you purchase insurance, make sure you ask in writing how much discount is being offered. As you can see above in the first image, we offer 40% (8404/21011) and not 50% so that we can sustain our operations and offer you the best service in case of a claim. This is the main reason you take insurance right!

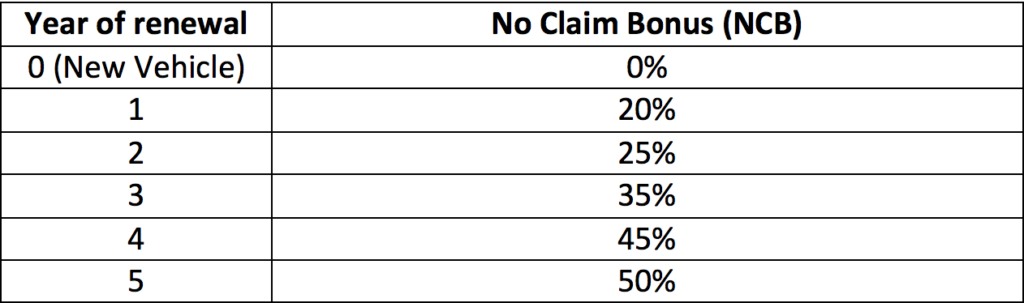

- No Claim Bonus (NCB): As the name suggests, it’s the bonus (discount actually) given to you by an insurance company during your policy renewal if in case you had no claim on your vehicle in the previous policy term. The longer you go without a claim, the higher your NCB. One interesting bit with NCB that I bet a lot of you might have not known or not been told is that you can transfer your existing vehicle’s NCB to a new vehicle in case you are planning to sell the existing vehicle for the new one. Also, one can still get a No Claim certificate from the insurance company even if he/she decides to transfer insurance of the existing vehicle to the new buyer. Some caveats in this process are the following

- No Claim Certificates is valid for 3 years

- You can’t transfer No Claim Bonus to another person

- No Claim Bonus can’t be transferred from a four-wheeler to a two-wheeler. It can only be done within the same category of vehicles

- Nil or Zero Depreciation: Besides the two components (OD and TP), one can opt for additional or add-on covers (think of it like toppings on your pizza or an ice cream) such as Nil Depreciation for their vehicle. Usually, in case of a claim, insurance company deducts depreciation from the amount to be paid to you and this depreciation can be very high leading to higher out-of-pocket expenses. For instance, the following is the depreciation schedule for some basic car parts as per IRDAI, the insurance regulatory body in India. Wouldn’t that be very expensive? Heck yeah! So, if you opted for a nil depreciation add-on, settlement is offered without considering the following depreciated value. Isn’t that sweet! The extra premium (15-20%) you might pay for this add-on is definitely worth the benefits in case of a claim, especially if your vehicle is brand new or less than 5 years old but a expensive one.

- Rubber, nylon, and plastic parts, and batteries – 50% deduction

- Fibre glass components – 30% deduction

- Wooden parts – as per age of car (5% for 1st year, 10% for 2nd year and so on)

- Compulsory Personal Accident (PA) cover for Owner-Driver: Third party (TP) premium in your policy is made up of basic TP premium (which is based on your vehicle’s engine capacity and is fixed irrespective of the year of renewal or other factors), PA cover for owner-driver and optional cover for unnamed occupants. Any bodily injury/death sustained by the owner-driver of the vehicle in direct connection to the insured vehicle or while being part of the insured vehicle will be compensated for by the insurance company with this add-on.

Besides the above, a customer can opt for other covers such as engine protection or invoice cover but these tend to be expensive and are rarely needed. Hence, I will leave you to the most important bits. Through this article, I hope we helped you understand some basic bits of insurance and where you can save the most the next time you are purchasing a new policy or renewing your existing one. If you are still not sure, just select ‘Get Quotes’ on our website and I bet you’ll be surprised to see how much you could have saved on your last renewal. Anyways, it’s never too late!